The explosion of cryptocurrencies—numbering over 25,000 with millions of tokens in circulation—stems from three converging forces: technological accessibility (anyone with moderate coding skills can launch an ERC-20 token), market specialization (investors demand coins for specific use-cases like privacy or transaction speed), and the democratization of monetary creation (bypassing traditional financial gatekeepers). The result? A landscape where genuine innovation coexists with redundancy and speculation, where only a select few currencies actually deliver substantive utility beyond their whitepaper promises.

How did the digital financial landscape evolve from a single cryptocurrency—Bitcoin—to an overwhelming ecosystem with thousands of tokens?

The proliferation stems from a convergence of technological innovation, market forces, and unprecedented accessibility.

Bitcoin’s 2009 debut merely uncovered the first layer of blockchain’s potential; subsequent developments revealed a multidimensional financial framework capable of supporting myriad applications beyond simple value transfer.

The introduction of smart contracts—Ethereum’s revolutionary contribution—fundamentally altered the cryptocurrency paradigm.

These self-executing contracts enabled developers to construct decentralized applications atop blockchain infrastructure, effectively transforming cryptocurrencies from mere digital cash into programmable platforms.

This technological watershed moment catalyzed an explosion of specialized tokens, each targeting distinct market niches or technical improvements.

Market demand further accelerates this multiplication.

As cryptocurrency adoption grows, users increasingly seek tokens tailored to specific requirements—whether prioritizing transaction speed (Litecoin), privacy (Monero), or cross-border payments (Ripple).

The diverse applications of blockchain technology naturally beget diverse implementations, with each new use case potentially warranting its own token ecosystem.

Perhaps most notably, the remarkable ease of cryptocurrency creation dramatically lowers barriers to entry.

Anyone with moderate technical knowledge can launch a token using standardized protocols like ERC-20, without dealing with traditional financial gatekeepers.

This democratization of monetary creation—unthinkable in conventional finance—inevitably leads to market saturation.

By 2025, the market reached a staggering milestone with over 25,000 active cryptocurrencies and more than 37 million crypto tokens in circulation.

Competition and imitation further compound this abundance.

This expansion has unfortunately created opportunities for bad actors, making due diligence essential when evaluating new cryptocurrency projects.

Successful cryptocurrencies invariably spawn competitors seeking to capitalize on established market demand while addressing perceived shortcomings.

This dynamic creates entire “families” of cryptocurrencies addressing similar use cases with marginally different implementations.

The cryptocurrency ecosystem now includes diverse token types such as stablecoins and DeFi tokens, each serving specialized functions within the broader market.

The result is a financial ecosystem simultaneously characterized by innovation and redundancy.

While thousands of cryptocurrencies nominally exist, a relative handful command significant market capitalization or genuine utility.

This proliferation represents both blockchain’s extraordinary potential and its growing pains—a financial adolescence marked by experimentation, overextension, and the occasional brilliant breakthrough that justifies the surrounding noise.

Frequently Asked Questions

How Do I Identify Which Cryptocurrencies Are Legitimate Investments?

Identifying legitimate cryptocurrency investments requires rigorous due diligence across multiple dimensions.

Investors should evaluate market liquidity (sufficient trading volume indicates genuine participant interest), scrutinize the project’s fundamental value proposition (does it solve actual problems?), and investigate the team’s credibility and transparency.

The project’s technical development activity, meaningful partnerships, and community engagement further differentiate substance from speculation.

Prudent investors remain wary of overhyped tokens lacking clear utility—cryptocurrency legitimacy often reveals itself through sustained development rather than marketing fanfare.

What Regulations Exist to Protect Cryptocurrency Investors?

Cryptocurrency investor protections remain a regulatory patchwork—simultaneously evolving and insufficient.

SEC oversight applies Howey Test principles to classify certain tokens as securities, triggering disclosure requirements and anti-fraud provisions.

Custody regulations mandate asset segregation and cold storage protocols, while accredited investor rules limit participation in certain offerings.

Yet regulatory gaps persist—particularly in cross-border enforcement—leaving investors vulnerable to schemes that would be promptly shuttered in traditional markets.

SIPA insurance particularly excludes non-securities crypto assets.

Can Cryptocurrencies Function Without Blockchain Technology?

Yes, cryptocurrencies can function without blockchain technology.

DAG-based systems like IOTA and Nano demonstrate viable alternatives that offer parallel transaction processing and improved scalability.

These systems maintain essential cryptocurrency attributes—decentralization, cryptographic security, and permissionless operation—while eliminating miners and reducing fees.

Though DAGs face unique security challenges and lack robust smart contract capabilities, they excel in enabling micro-transactions and machine-to-machine payments, particularly in IoT environments where blockchain’s linear transaction processing proves cumbersome.

How Do Environmental Concerns Impact Different Cryptocurrencies?

Environmental concerns impact cryptocurrencies unevenly across the ecosystem.

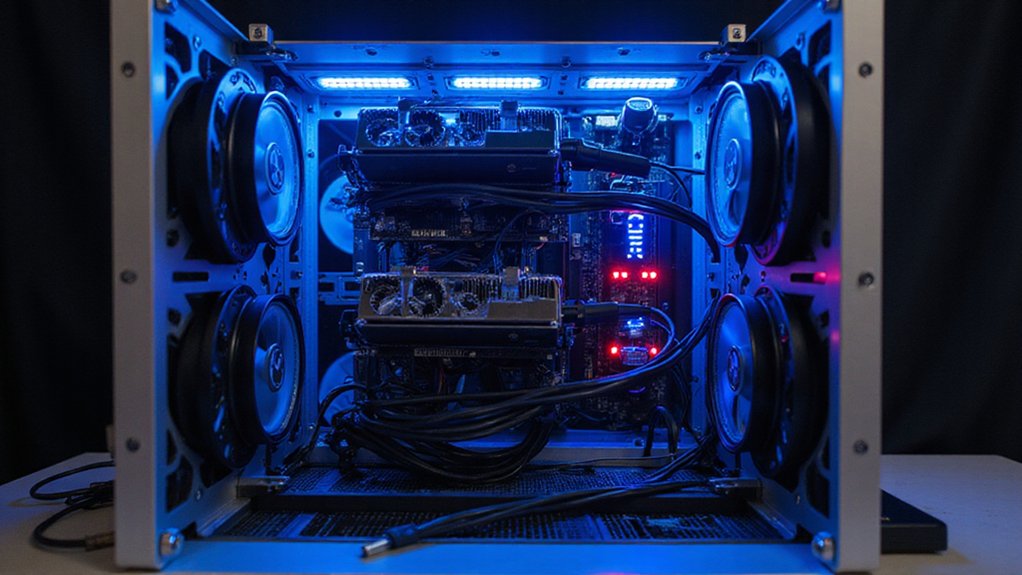

Proof-of-Work networks like Bitcoin face increasing scrutiny for their substantial energy footprints (707 kWh per transaction), while Proof-of-Stake alternatives enjoy preferential treatment from ESG-conscious investors.

This bifurcation has catalyzed a market migration toward greener consensus mechanisms, with regulatory bodies worldwide contemplating energy standards that could effectively price carbon-intensive blockchains out of legitimate markets.

The industry’s response? A flurry of carbon offset programs—some substantive, others mere window dressing.

Will Cryptocurrencies Ever Replace Traditional Banking Systems?

While cryptocurrencies may not fully replace traditional banking, they’re increasingly positioned to transform it fundamentally.

The integration of DeFi protocols, blockchain’s enhanced security, and elimination of intermediaries provide compelling alternatives to conventional systems.

However, cryptocurrencies face substantial hurdles—regulatory uncertainty, environmental concerns¹, volatility, and widespread adoption barriers.

The future likely holds hybrid models incorporating cryptocurrency innovations within evolved banking frameworks rather than wholesale replacement.

Central banks’ CBDC development suggests traditional institutions are adapting rather than surrendering their financial dominance.

¹As previously discussed, proof-of-work cryptocurrencies raise significant environmental concerns compared to proof-of-stake alternatives.