Mt. Gox was once the world’s dominant Bitcoin exchange, handling over 70% of global transactions before its spectacular collapse in 2014. Originally created as a Magic: The Gathering card trading platform (hence the acronym), this Tokyo-based operation pivoted to cryptocurrency and quickly became Bitcoin’s price-setting nexus. Its implosion—resulting in approximately 850,000 lost Bitcoins—triggered years of legal proceedings and fundamentally reshaped exchange security protocols. The exchange’s cautionary tale continues to influence cryptocurrency governance frameworks today.

A cautionary tale etched into cryptocurrency lore, Mt. Gox emerged in 2010 as the brainchild of Jed McCaleb—remarkably, as a platform for trading Magic: The Gathering cards (hence the acronym “Magic: The Gathering Online Exchange”). This humble origin bears little resemblance to what the exchange would become after its swift pivot to Bitcoin trading and subsequent transfer to Mark Karpeles in 2011. Under Karpeles’s stewardship, the Tokyo-based operation rapidly ascended to dominate the nascent cryptocurrency landscape.

At its zenith, Mt. Gox processed over 70% of global Bitcoin transactions—a staggering volume exceeding 100,000 Bitcoins daily—effectively establishing itself as the primary price discovery mechanism during Bitcoin’s formative years. Such concentration of trading power in a single, relatively unsophisticated exchange platform would, in retrospect, prove catastrophically ill-advised.

The exchange’s spectacular implosion in February 2014 sent shockwaves through the cryptocurrency ecosystem when operations abruptly ceased amid revelations of massive Bitcoin losses. McCaleb had adopted the Bitcoin concept after reading about it on Slashdot in July 2010. The exchange had previously experienced significant hacks in 2011 that should have served as warning signs of its security vulnerabilities.

The seismic collapse of Mt. Gox reverberated through digital finance, abruptly halting operations as staggering cryptocurrency losses came to light.

Approximately 850,000 Bitcoins had vanished—purloined through security vulnerabilities that management had apparently overlooked—representing hundreds of millions in dollar value at contemporary prices. The loss contributed significantly to the phenomenon of lost bitcoins that economists estimate comprises 17-25% of Bitcoin’s total supply. The subsequent bankruptcy filing marked one of the most significant financial disasters in cryptocurrency’s young history.

Years of complex legal proceedings followed as creditors sought recompense through Japanese courts. A rehabilitation plan eventually materialized in 2021, offering some measure of resolution to the labyrinthine insolvency case that had sprawled across nearly a decade.

Mt. Gox’s ignominious demise catalyzed substantial reforms in cryptocurrency exchange governance. The exchange’s failure accentuated the imperative for robust security protocols, regulatory frameworks, and custody solutions—transforming a devastating setback into valuable, if painfully acquired, industry wisdom. Today, Mt. Gox stands as both monument and warning: an object lesson in the dangers of centralized control, insufficient security infrastructure, and inadequate oversight in the still-evolving digital asset ecosystem.

Frequently Asked Questions

How Did Mt. Gox Get Its Unusual Name?

Mt. Gox derived its peculiar name from “Magic: The Gathering Online eXchange,” reflecting founder Jed McCaleb’s original 2007 vision for a card-trading platform—abandoned after mere months.

When McCaleb repurposed the domain for Bitcoin trading in 2010, the unrelated acronym curiously persisted.

This linguistic vestige of gaming culture underscores cryptocurrency’s eclectic origins and serves as an ironic footnote to what would become, rather notoriously, the largest Bitcoin exchange before its spectacular 2014 collapse.

Can Victims of the Mt. Gox Hack Still Recover Their Funds?

Yes, Mt. Gox victims can still recover a portion of their funds, though the process remains painfully protracted.

Creditors stand to receive approximately 0.23 BTC for every Bitcoin lost—a fraction that, while disappointing, represents some consolation after a decade-long wait.

The bankruptcy proceedings continue their glacial progression, with recovered assets held in trust awaiting distribution.

Recent legal developments, including charges against Russian nationals, have renewed interest but haven’t accelerated the compensation timeline.

Why Wasn’t Mt. Gox’s Security Breach Detected Earlier?

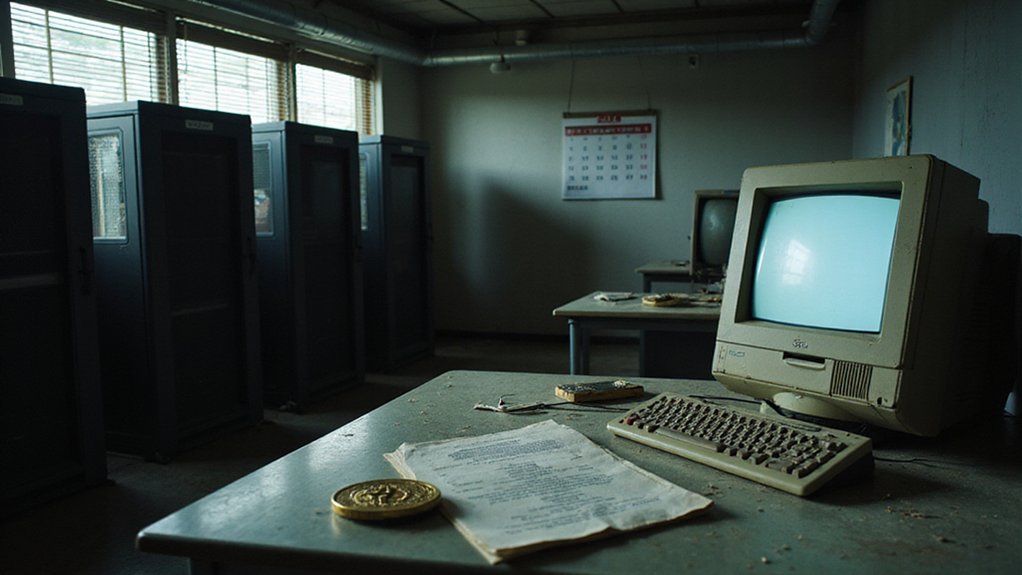

Mt. Gox’s security breach evaded early detection due to a perfect storm of technical inadequacies.

The exchange operated with substandard security monitoring systems, limited technical expertise, and poor management oversight—a trifecta of vulnerabilities that practically invited disaster.

Its infrastructure lacked real-time threat detection capabilities, while insufficient access controls effectively left doors ajar for unauthorized intrusions.

This security architecture, woefully inappropriate for an operation handling millions in digital assets, rendered the exchange incapable of identifying sophisticated manipulation of transaction records.

Who Was Legally Held Responsible for Mt. Gox’s Collapse?

Mark Karpelès, Mt. Gox’s CEO, bore the legal burden for the exchange’s spectacular implosion.

Tokyo courts found him guilty of falsifying data (inflating holdings by $33.5 million) while—somewhat remarkably—acquitting him of embezzlement charges.

His 30-month prison sentence was suspended for four years, effectively allowing him to avoid incarceration unless further transgressions occurred.

Despite the exchange’s catastrophic $450 million Bitcoin loss, criminal liability remained surprisingly contained to Karpelès alone.

What Security Lessons Did the Crypto Industry Learn From Mt. Gox?

The Mt. Gox collapse delivered a masterclass in cryptocurrency security failures, forcing the industry to embrace cold storage protocols, multi-signature wallets, and regular security audits.

Exchanges learned—rather painfully—that transparency isn’t optional and thorough monitoring systems are essential for detecting malfeasance.

The debacle catalyzed regulatory frameworks for digital assets and underscored the importance of disaster recovery planning.

Perhaps the most enduring lesson? The quaint notion that security is an investment, not an expense.