Ether (ETH) functions as both the native currency and operational fuel for the Ethereum blockchain ecosystem. Unlike conventional currencies, ETH transcends mere value storage by powering computational processes, smart contracts, and decentralized applications through gas fees. This dual-purpose design—where the currency simultaneously serves as functional necessity and tradable asset—creates a self-sustaining economic model. Following its 2022 shift to proof-of-stake consensus, Ether has established itself as a more environmentally responsible digital asset with intrinsic utility beyond speculation.

Ether (ETH) stands as the lifeblood of the Ethereum ecosystem—a cryptocurrency that transcends mere digital coinage to serve as the essential fuel powering an entire blockchain universe.

Unlike conventional currencies merely facilitating value exchange, Ether performs double duty: it operates both as a tradable asset and as the computational gas that propels the platform’s vast network of decentralized applications (one might say it’s currency with an existential purpose).

Ethereum’s native currency transcends traditional value storage—it’s both investment vehicle and computational necessity, money that literally powers its own existence.

This digital commodity maintains the Ethereum infrastructure through an elegantly self-sustaining economic model—validators stake ETH to participate in consensus and, in return, receive ETH rewards for their computational contributions.

When users transact on Ethereum, they pay fees denominated in “gas,” expressed ultimately in tiny fractions of Ether called wei (10^18 wei equals one ETH, a denomination system that would make traditional banking’s cents seem positively simplistic).

The currency exists within a larger technological context that separates it from other cryptocurrencies. The network aims to maintain balance by minting approximately 1,700 new tokens daily, balancing supply with demand.

While Bitcoin primarily functions as digital gold, Ether powers programmable finance through smart contracts—self-executing agreements that eliminate intermediaries with ruthless efficiency.

These automated protocols require ETH to operate, creating intrinsic utility beyond speculative value.

As developers deploy applications ranging from decentralized exchanges to digital art marketplaces, each transaction necessarily consumes ETH, driving demand for this native currency.

From a market perspective, Ether maintains second position in the cryptocurrency hierarchy, offering substantial liquidity while establishing itself as both investment vehicle and functional necessity.

Its value fluctuates based on network usage, market sentiment, and macroeconomic factors—a triumvirate of influences that keeps traders perpetually vigilant (and occasionally bewildered).

The currency’s relationship to its parent platform exemplifies symbiotic design: Ethereum provides the technological foundation that gives ETH purpose, while ETH provides the economic incentives necessary for Ethereum to function securely.

This interdependence creates a self-reinforcing ecosystem where currency and platform evolve in tandem, each enhancing the other’s utility and value.

The significant reduction in energy consumption achieved through the transition to proof-of-stake consensus in September 2022 has further strengthened Ether’s position as an environmentally responsible cryptocurrency option.

The implementation of EIP-1559 upgrade has revolutionized Ethereum’s economics by burning transaction fees, effectively reducing overall supply and potentially supporting long-term value appreciation.

Frequently Asked Questions

Is Ether a Good Investment Compared to Bitcoin?

Whether Ether represents a superior investment to Bitcoin depends largely on one’s risk appetite and investment thesis.

Bitcoin, with its first-mover advantage and “digital gold” narrative, offers relative stability within the volatile crypto ecosystem.

Ethereum, meanwhile, presents potentially higher growth prospects through its expansive ecosystem of DeFi applications and NFTs, albeit with heightened volatility.

The prudent investor might consider both assets as complementary portfolio components rather than mutually exclusive propositions—each serving distinct functions in the evolving digital asset landscape.

How Do I Safely Store My Ether?

Storing Ether safely involves a prudent combination of security measures.

Hardware wallets (Ledger, Trezor) offer robust protection for significant holdings, while software wallets provide convenience for frequent transactions.

Cold storage—keeping private keys offline—remains the gold standard for long-term hodlers.

Multi-signature arrangements add formidable protection layers, requiring multiple approvals for transactions.

Regular backups, two-factor authentication, and vigilance against phishing attempts round out a thorough security protocol.

The cardinal rule? Never, under any circumstances, share private keys.

What Are the Tax Implications of Trading Ether?

Trading Ether triggers capital gains tax obligations—a fact many enthusiasts conveniently overlook until tax season arrives.

The IRS classifies ETH as property, not currency, requiring traders to report every transaction (yes, every single one).

Short-term gains face ordinary income rates up to 37%, while long-term positions enjoy preferential treatment.

Staking rewards? Taxed as ordinary income upon receipt.

The record-keeping burden alone explains why accountants specializing in crypto command premium fees.

Can Ether Be Mined Like Bitcoin?

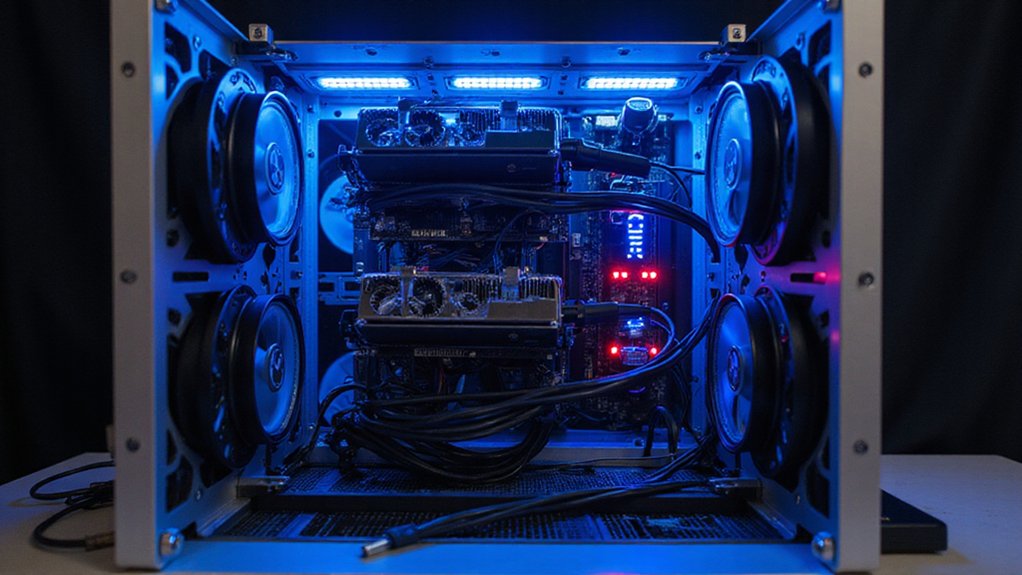

Ether could historically be mined similar to Bitcoin using Proof of Work, with miners deploying GPU rigs to solve cryptographic puzzles for block rewards.

However, Ethereum’s 2022 “Merge” shift to Proof of Stake rendered mining obsolete.

This seismic shift (which some miners greeted with predictable enthusiasm¹) replaced computational mining with staking—where validators simply lock up existing ETH as collateral to secure network operations and earn rewards.

¹The enthusiasm was, naturally, primarily expressed through colorful expletives and fire sales of GPU equipment.

What Determines Ether’s Price Fluctuations?

Ether’s price oscillations stem from a complex interplay of market forces.

Bitcoin’s movements typically set the broader crypto tone, while supply-demand dynamics—particularly staking activity that constrains circulating supply—create price pressure.

Technological upgrades (the much-vaunted “Merge” being a prime example) often trigger speculative rallies.

Meanwhile, regulatory developments and institutional adoption patterns introduce their own gravitational effects.

On-chain activity metrics frequently serve as harbingers of price movements, reflecting the network’s fundamental health beyond mere trading sentiment.