In cryptocurrency contexts, “CA” most commonly refers to Contract Address—the alphanumeric identifier that pinpoints a smart contract’s location on blockchains like Ethereum. However, the term exhibits remarkable polysemy, variously denoting Certified Accountants who navigate regulatory compliance, Crypto Assets in general parlance, Certificate Authorities that validate digital identities, or Coin Allocation patterns that reveal token distribution structures. Context proves essential in deciphering this acronym’s intended meaning within the dense linguistic ecosystem of digital assets.

The abbreviation “CA” in cryptocurrency circles represents a striking example of how specialized terminology can assume multiple meanings within a single domain—each interpretation carrying significant implications for investors, developers, and market participants.

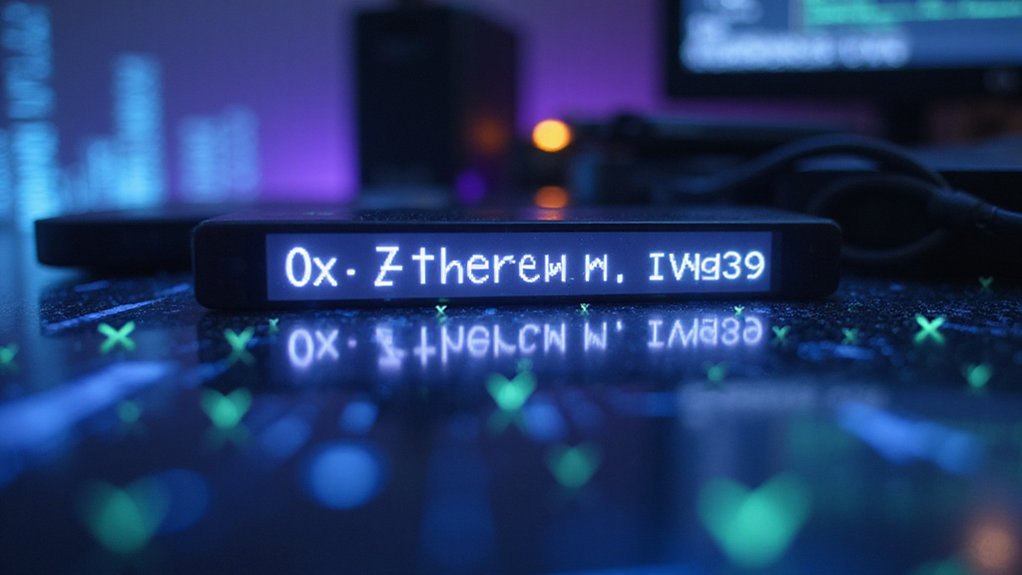

Perhaps most commonly, “CA” denotes Contract Address, the alphanumeric identifier that serves as the digital location for smart contracts deployed on networks like Ethereum or Binance Smart Chain.

The humble Contract Address—a cryptographic North Star guiding developers and investors through the constellations of blockchain protocols.

This technical fingerprint enables users to interact with specific tokens or decentralized applications while providing an essential verification mechanism against the ever-present specter of fraudulent copycats.

In the domain of tokenomics—that curious intersection of economics and digital assets—”CA” frequently references Coin Allocation, outlining how a project’s total token supply is distributed across various functions.

A transparent allocation model (50% for staking rewards, perhaps 30% for liquidity provisions, with the remainder reserved for development and team incentives) often differentiates serious ventures from less scrupulous operations.

Savvy investors scrutinize these distributions with the same intensity traditional analysts reserve for balance sheets.

Regulated crypto enterprises increasingly require the services of Certified Accountants (also abbreviated as “CA”), professionals maneuvering the labyrinthine intersection of traditional financial regulations and novel digital asset classes.

These financial practitioners—armed with spreadsheets rather than mining rigs—help maintain compliance in a regulatory landscape that shifts with tectonic unpredictability.

The term may also refer to Crypto Assets broadly, Certificate Authorities that validate blockchain identities, or even the specific Coupon Assets token trading on various exchanges. In blockchain networks, Certificate Authorities play a crucial role by issuing TLS certificates that secure communication channels between users and network components. These certificates function similarly to the immutable nature of smart contract code that automatically executes predefined conditions without intermediary intervention.

This polysemy¹ reflects the crypto industry’s tendency toward dense jargon—a linguistic efficiency that simultaneously facilitates precise communication among insiders while erecting barriers to newcomers.

Understanding these varied meanings of “CA” isn’t merely academic; it represents practical knowledge essential for effective participation in cryptocurrency ecosystems.

As with many aspects of this digital financial frontier, context remains sovereign in determining which definition applies to a particular discussion.

¹The existence of multiple meanings for a single term.

Frequently Asked Questions

How Do Scammers Use Fake CAS in Crypto Schemes?

Scammers deploy fake CAs (Contract Addresses) by creating deceptive duplicates of legitimate tokens, altering just a few characters to trap the unwary.

They similarly exploit Coin Allocation data with fabricated distribution metrics, impersonate Certified Accountants to feign legitimacy, and leverage terminology confusion around “CA” abbreviations.

This multi-pronged approach—combining technical forgery with psychological manipulation—creates a perfect storm where ambiguity meets avarice, separating investors from their digital assets with alarming efficiency.

What Tools Help Verify Crypto CA Legitimacy Before Investing?

Investors can verify crypto contract addresses using blockchain explorers (Etherscan, BscScan) that reveal transaction histories and code audits—the digital equivalent of peeking behind the wizard’s curtain.

Token legitimacy checks should include exchange listings, smart contract audits, thorough whitepaper analysis, and community sentiment evaluation.

Risk management tools like CoinMarketCap help analyze token allocations and price movements, while independent audits serve as financial “background checks” that—surprisingly often—reveal discrepancies worth avoiding.

CAn Regulatory Changes Affect CA Certification in Blockchain Projects?

Regulatory changes substantially impact CA certification across blockchain ecosystems. When authorities tighten requirements for Certificate Authorities, blockchain projects must adapt their security protocols and verification processes. Similarly, regulations affecting Contract Address validation can necessitate technical overhauls. Coin Allocation frameworks face particular scrutiny as regulators increasingly demand transparency in token distribution. Even Certified Accountants working with crypto firms must continuously adjust their practices as financial reporting standards evolve—a regulatory ripple effect that permeates every interpretation of the “CA” acronym.

How Frequently Should Crypto Projects Renew Their CA?

Crypto projects should typically renew their Certificate Authority credentials every 1-3 years, though ideal frequency varies based on several critical factors.

Permissioned networks generally require more frequent renewal than their permissionless counterparts, while regulatory compliance and data sensitivity may necessitate shorter cycles.

Projects handling high-value transactions (where certificate compromise would prove catastrophic) should err toward annual renewals.

Ultimately, each project must balance security requirements against operational overhead—a calculation that becomes particularly nuanced for rapidly evolving platforms.

What’s the Difference Between Centralized and Decentralized CAS?

The difference between centralized and decentralized CAs boils down to control architecture and trust models.

Centralized CAs operate hierarchically with a single authority managing certificate issuance—efficient but vulnerable to single-point failures.

Decentralized CAs, often blockchain-based, distribute control across multiple nodes, creating a more resilient system through collective verification.

While centralized systems excel at compliance and streamlined management, their decentralized counterparts offer greater user autonomy and security through distributed consensus—a trade-off between efficiency and resilience that crypto projects must navigate.