Crypto mining serves as the backbone of blockchain networks, requiring specialized computers to solve complex mathematical puzzles. Miners validate transactions, add new blocks to the chain, and earn newly minted coins plus transaction fees as rewards. The process—evolving from CPU mining to energy-intensive ASIC operations—maintains network security through computational competition. Mining difficulty adjusts automatically to guarantee consistent block times, while participants can mine individually or pool resources for proportional returns. Further exploration reveals the delicate balance between profitability and environmental impact.

How exactly does digital currency transform from abstract code into tangible value?

The answer lies in a process called crypto mining—a computational endeavor that simultaneously validates transactions, secures blockchain networks, and introduces new digital coins into circulation.

This digital equivalent of resource extraction serves as the backbone of decentralized cryptocurrency systems, enabling trustless peer-to-peer transactions without the oversight of traditional financial intermediaries.

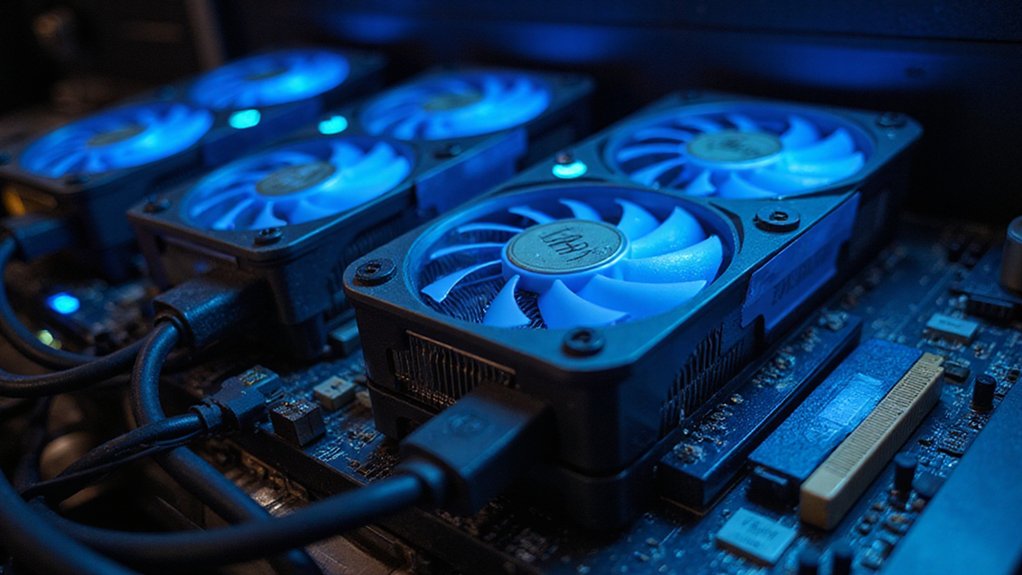

At its core, crypto mining involves an elaborate computational competition where specialized machines (nodes) race to solve cryptographic puzzles through brute-force calculation.

Specialized machines engage in a high-stakes digital race, relentlessly computing solutions to cryptographic challenges through sheer computational force.

These puzzles, based on hash functions that produce unique outputs for any given input, require miners to discover a specific hash value that meets predetermined difficulty criteria—essentially finding a needle in a digital haystack.

The first miner to crack this mathematical conundrum broadcasts their solution to the network, which then verifies its accuracy.

Upon confirmation, the victorious miner adds the new block of validated transactions to the blockchain and receives freshly minted cryptocurrency as compensation for their computational labor.

The difficulty of these cryptographic puzzles adjusts automatically to maintain consistent block times, regardless of how much computing power joins or leaves the network.

This self-regulating mechanism guarantees blocks aren’t solved too quickly or slowly, preserving network integrity while establishing a competitive landscape where probability of success correlates directly with computational contribution.

The hardware required for this digital prospecting has evolved dramatically—from ordinary CPUs to specialized ASIC machines capable of performing quintillions of calculations per second, all while consuming electricity at rates that have raised substantial environmental concerns.

Miners’ motivation stems from dual revenue streams: block rewards (new coins) and transaction fees.

Mining operations can be conducted anywhere from large corporate facilities to individual homes, as the process fundamentally requires only a computer and power source to participate in the global verification network.

These incentives, which diminish over time through programmed events like Bitcoin’s halving, create a fascinating economic model where rational self-interest powers collective security.

The result? A system where mathematical consensus replaces institutional trust, transforming computational work into digital wealth through an elegant fusion of cryptography, game theory, and distributed computing.

Miners use a special number called a nonce when hashing transactions in their attempt to find a hash value below the target threshold, often incrementing this value billions of times before finding a solution.

For those seeking to enhance their success rate, pool mining allows multiple participants to combine their computational resources and share rewards proportionally.

Frequently Asked Questions

How Much Electricity Does Crypto Mining Consume?

Cryptocurrency mining’s electricity consumption is staggering, with Bitcoin alone demanding between 91-150 terawatt-hours annually—comparable to entire nations like Finland or Poland.

Despite hardware efficiency improvements, overall consumption remains elevated as cryptographic puzzles grow increasingly complex.

While over 50% of operations now utilize renewable energy (a nod to sustainability that skeptics might find underwhelming), mining still constitutes approximately 2.3% of U.S. electricity usage, prompting regulatory scrutiny and raising legitimate concerns about grid stability and environmental impact.

Can I Mine Crypto on My Smartphone?

Smartphone mining exists in theory but remains an exercise in digital futility.

While mobile-friendly cryptocurrencies like Monero and Bytecoin employ algorithms optimized for CPU mining, the harsh reality of economics renders the practice largely symbolic.

The combination of thermal constraints, accelerated battery degradation, and negligible rewards (often measured in fractions of cents) makes smartphone mining less a viable income stream and more an expensive way to transform one’s device into a pocket-sized space heater.

Is Mining Different for Bitcoin Versus Other Cryptocurrencies?

Mining differs substantially between Bitcoin and other cryptocurrencies.

While Bitcoin employs the energy-intensive SHA-256 algorithm requiring specialized ASIC hardware and facing astronomical difficulty levels (80T by mid-2024), altcoins often utilize alternative algorithms accessible to GPU miners.

Many newer cryptocurrencies have abandoned Proof-of-Work entirely for Proof-of-Stake, eliminating traditional mining altogether.

Economic structures vary too—Bitcoin’s halving events create unique reward dynamics compared to altcoins with different tokenomic models and difficulty adjustment mechanisms.

Do I Need Special Permits to Mine Crypto?

Special permits for crypto mining depend entirely on one’s jurisdiction—a regulatory patchwork that would make Kafka proud.

While hobbyist mining on personal equipment typically requires no permits, commercial operations often necessitate licensing, particularly in countries with stringent regulatory frameworks like Russia.

Environmental impact assessments may be mandatory where energy consumption raises concerns.

Local zoning laws, utility regulations, and tax registration requirements further complicate matters.

Due diligence regarding local regulations is non-negotiable for serious miners contemplating significant operations.

How Long Does It Take to Mine One Coin?

Mining a single Bitcoin demands patience bordering on monastic devotion—somewhere between several years to mere days, depending entirely on one’s hardware investment.

With modest setups (5 ASICs), expect nearly four years of waiting; industrial operations boasting thousands of miners can compress this to under a week.

The process remains fundamentally probabilistic, with network difficulty adjustments every fortnight ensuring that no amount of computational firepower guarantees predictable outcomes.

Most miners wisely join pools, accepting fractional rewards for statistical sanity.