Building a crypto mining rig requires assembling specialized components: a multi-GPU compatible motherboard, basic CPU, powerful graphics cards, and adequate power supply. Start with a static-free workspace, carefully mount hardware, connect risers for improved airflow, and install mining-specific software—typically Linux-based for efficiency. Proper wallet configuration guarantees earnings storage. The profitability equation balances hardware investment against electricity costs and cryptocurrency volatility. The technical assembly merely initiates the journey toward blockchain participation.

Why venture into cryptocurrency mining when you can simply purchase digital assets? For many enthusiasts, the allure lies in the process itself—a hands-on approach to blockchain participation that combines technical prowess with financial speculation. The construction of a mining rig represents an investment in infrastructure rather than mere currency acquisition (though profitability remains, naturally, the ultimate objective).

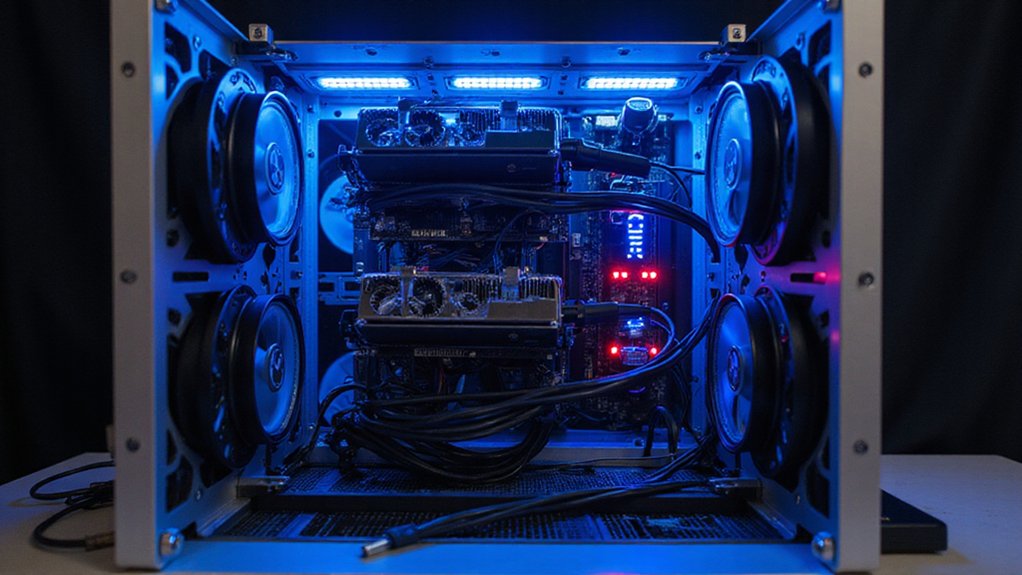

Assembling a mining rig begins with component selection, where the motherboard serves as the foundation upon which all other elements depend. One must select a board capable of supporting multiple GPUs—the veritable workhorses of any mining operation.

The motherboard stands as the critical bedrock of any mining operation, necessitating careful selection to accommodate multiple GPU workhorses.

The processing demands of mining algorithms necessitate significant graphical computation power, rendering the CPU a surprisingly secondary consideration; a basic processor suffices where GPUs shoulder the algorithmic burden. Mining involves solving complex mathematical puzzles that validate transactions and secure the blockchain network.

Prior to assembly, a static-free workspace must be established. The meticulous unpacking and organization of components—risers, cables, and mounting hardware—precedes the actual construction phase.

The process continues with CPU installation, requiring precise alignment with the motherboard socket and application of thermal paste—a seemingly trivial detail that nevertheless impacts long-term performance and hardware longevity. Most miners opt for 8th or 9th-generation Intel or AMD processors to ensure optimal compatibility with mining-focused motherboards.

Once the motherboard is mounted securely to the frame (with proper grounding to prevent static damage), attention turns to the installation of graphics cards. These must be aligned with PCIe slots and connected via riser cables, which facilitate improved airflow throughout the system.

Power connections from an appropriately robust PSU must supply each component with adequate electricity—an underpowered system represents a common yet entirely preventable failure point. The power supply unit should be selected to provide adequate power for all components including multiple power-hungry GPUs.

The final configuration involves software installation—typically Linux-based for efficiency—alongside mining-specific programs and wallet setup for earnings storage.

Performance testing completes the assembly process, confirming stable operation under expected computational loads. This intricate symphony of hardware and software, when properly orchestrated, transforms raw computational power into cryptocurrency assets—a conversion that, despite its technical complexity, contains an elegance appreciated by those who understand the underlying mechanisms.

Frequently Asked Questions

What’s the ROI Timeframe for a Typical Mining Rig?

ROI timeframes for mining rigs vary dramatically—a reflection of cryptocurrency’s volatility.

Typical mid-range GPU setups might require 18-24 months at $0.10/kWh, while premium ASIC miners potentially achieve profitability in 9-24 months, contingent on electricity costs and market conditions.

The sobering reality? At standard residential rates ($0.12/kWh), many rigs face extended 8+ year ROIs—though this timeline contracts considerably at industrial rates or during bull markets.

How Much Noise Does a Mining Rig Produce?

Mining rigs typically produce between 50-90 decibels of noise—roughly equivalent to everything from a quiet office to a nightclub.

Fan-cooled systems (the majority) hover around 70-90dB, while specialized GPU setups with optimized cooling can dip to 30-40dB.

This isn’t merely an annoyance; prolonged exposure above 80dB risks hearing damage, triggering lawsuits in places like Australia and Texas when miners’ mechanical symphonies disturb the peace.

Can Mining Rigs Cause Electrical Hazards in Residential Settings?

Mining rigs absolutely present significant electrical hazards in homes.

Their voracious power consumption frequently overloads residential circuits—which, unsurprisingly, weren’t designed for industrial-scale operations.

The consequences? Overheated wiring, frequent circuit breaker trips, and potential fire hazards.

Without dedicated high-amperage circuits, proper load balancing, and appropriately rated cables (which most DIY enthusiasts woefully underestimate), these power-hungry behemoths transform ordinary residences into potential electrical infernos waiting to happen.

Are There Tax Implications for Crypto Mining Profits?

Cryptocurrency mining profits don’t escape the taxman’s clutches.

Mined coins constitute income—taxable at fair market value upon receipt—while subsequent disposal may trigger capital gains taxes.

Miners must maintain meticulous transaction records (tracking acquisition dates and values), and typically report via Form 1040 with Schedule C if operating as a business.

Equipment depreciation and electricity costs may offset taxable income, though the IRS’s byzantine reporting requirements remain somewhat incongruous with crypto’s decentralized ethos.

How Often Should I Replace Hardware Components?

Hardware replacement schedules vary by component and operational conditions.

Fans typically require earliest intervention when slowing or failing despite maintenance.

PSUs should be replaced upon signs of instability.

GPUs and ASICs generally last 2-4 years under ideal conditions, while motherboards may endure longer barring failures.

Environmental factors—particularly heat, dust, and power quality—substantially accelerate wear, necessitating vigilant monitoring rather than rigid schedules.

Preventative maintenance often extends component life expectancy considerably.