Winning Bitcoin without purchasing involves several approaches: interest-bearing accounts yield passive returns on existing holdings, while DeFi protocols offer up to 6% APY through wrapped Bitcoin. Less capital-intensive methods include microtasks (faucets and games), though returns prove amusingly minuscule relative to effort invested. Referral programs and security bounties reward network expansion and technical acumen respectively, requiring no initial investment. Mining, once accessible to hobbyists, now demands industrial-scale resources—a striking evolution that underscores cryptocurrency’s maturation journey.

Why simply purchase Bitcoin when there are myriad methods to acquire the world’s leading cryptocurrency without directly depleting one’s fiat reserves?

The digital asset landscape offers a veritable buffet of opportunities for those seeking to accumulate satoshis without conventional buying—though each path carries its own unique risk-reward calculus.

One might consider depositing existing Bitcoin holdings into interest-bearing accounts through platforms like YouHodler or Nexo, effectively transforming idle assets into income-generating instruments.

The passive nature of this approach appeals to the set-it-and-forget-it investor, though platform security concerns remain an ever-present specter in this relatively unregulated domain.

For the DeFi-curious, wrapping Bitcoin (WBTC) enables participation in staking protocols that can yield up to 6% APY—not insignificant in today’s financial landscape.

This approach, while technically not “staking” in the proof-of-stake sense Bitcoin purists would recognize, nevertheless provides similar economic benefits through Ethereum’s ecosystem.

The more time-rich might explore Bitcoin faucets and play-to-earn games, though the returns often prove comically minuscule relative to effort expended.

These microtask platforms basically monetize attention, paying fractional satoshis for completed surveys or website testing—hardly a path to financial independence, but perhaps an educational onramp.

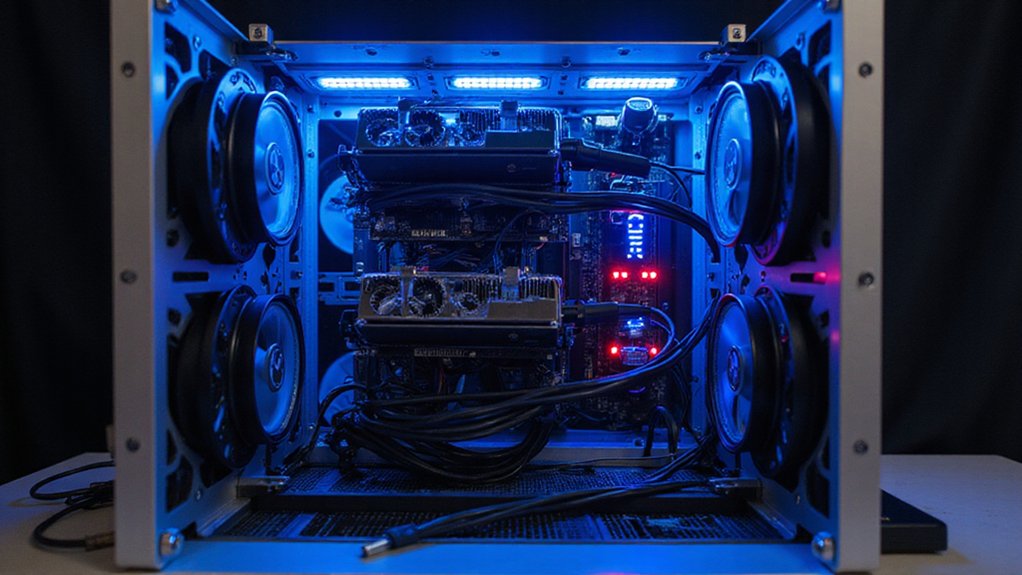

Mining, once accessible to hobbyists, has evolved into an industrial-scale operation requiring significant capital outlays for ASICs and electricity.

The days of profitable laptop mining have gone the way of sub-$100 Bitcoin.

Affiliate marketing presents a middle path, wherein one’s social capital converts to Bitcoin through commission structures.

Each successful referral to cryptocurrency services yields compensation—a digital age twist on the time-honored practice of monetizing influence.

Trading remains viable for those with market acumen, though the volatility that makes Bitcoin potentially profitable also introduces substantial risk.

As veterans of market cycles can attest, timing Bitcoin’s movements consistently requires either supernatural foresight or extraordinary luck—sometimes both.

For those seeking to avoid initial investments altogether, participating in bug bounty programs offered by major exchanges like Coinbase can provide substantial rewards for identifying security vulnerabilities.

Understanding the difference between wallet types is essential for choosing the right balance of security and accessibility for your Bitcoin storage needs.

Before investing in any cryptocurrency, it’s crucial to set up a secure digital wallet where your bitcoins can be safely stored and managed.

Frequently Asked Questions

Are Bitcoin Earnings Taxable in My Country?

Bitcoin earnings are generally taxable in most countries, with classifications ranging from property to income.

Without knowing the specific jurisdiction in question (an oversight in the inquiry that tax authorities would find less amusing), one can only state that crypto-related activities—mining, staking, trading gains—typically trigger tax events.

The regulatory landscape continues evolving, with tax rates spanning from zero (in crypto-friendly havens) to Japan’s eyebrow-raising 55% maximum.

How Do I Secure My Bitcoin Wallet From Hackers?

Securing a Bitcoin wallet from hackers requires implementing multiple defensive layers.

Users should employ hardware wallets for offline storage, enable multi-factor authentication, utilize multi-signature functionality (requiring multiple approvals for transactions), and maintain regular backups of wallet data.

Encryption with strong passwords and biometric protection adds further security.

Remaining vigilant against phishing attempts and keeping devices malware-free constitutes basic hygiene for the prudent Bitcoin holder—who, one assumes, prefers not to become an unwitting donor to cybercriminals.

What Are the Risks of Participating in Bitcoin Giveaways?

Bitcoin giveaway participation entails substantial risks: impersonation scams where fraudsters pose as celebrities or projects; financial theft through upfront “verification” fees; malware installation via malicious links; and smart contract traps that siphon legitimate assets.

The psychological manipulation—leveraging FOMO and greed—often overrides rational judgment, while security vulnerabilities arise when sharing private keys or personal information.

These schemes, frequently operating with remarkable sophistication, represent textbook examples of social engineering at its most pernicious.

Can I Mine Bitcoin Using My Smartphone?

While technically feasible, smartphone Bitcoin mining represents perhaps the most spectacular exercise in futility within the crypto landscape.

Modern ASICs deliver trillions of hashes per second while simultaneously depleting your device’s battery, overheating components, and yielding returns so microscopic they’re practically theoretical.

Beyond educational value, smartphone mining offers nothing but premature hardware degradation—the digital equivalent of using a spoon to excavate the Mariana Trench.

How Much Energy Does Bitcoin Mining Consume?

Bitcoin mining consumes a staggering amount of energy—between 91-240 TWh annually, representing approximately 0.55% of global electricity consumption.

This appetite rivals the energy usage of entire nations such as Finland or the Netherlands.

The environmental footprint is equally substantial, generating roughly 69 million metric tons of CO₂ annually, though the industry is gradually pivoting toward renewable energy sources (now exceeding 50% in some regions).